The choice of payment options in an online shop has a significant impact on the customers’ purchasing decisions. As an international online retailer, it is essential to know the needs of your target group and to offer appropriate payment options. According to ACI’s Basant Singh, the number of mobile payments is expected to grow to 53% by 2025, which means merchants must always react to new developments in payments.

Customer satisfaction is the top priority for retail companies, whether online or stationary. Online merchants should therefore take their customers’ preferences into account and offer the preferred payment options. A diverse choice of payment methods is particularly important in order to meet customer expectations. Being flexible and offering a wide range of payment options is especially crucial for international sales. By adapting to the habits of customers in the target country and reacting to new trends in good time, an online shop can assert itself against the competition.

The choice of payment options plays a crucial role in the success of an online shop . According to a study by the Baymard Institutebreak about 70%of website visitors abandon their purchase, often due to von Concerns about the security of their credit card information orof a complicated checkout process. one tosmall selection of payment optionsis also a common reason for abandonment. By providing various reliable payment methods, many abandoned purchases can be avoided.

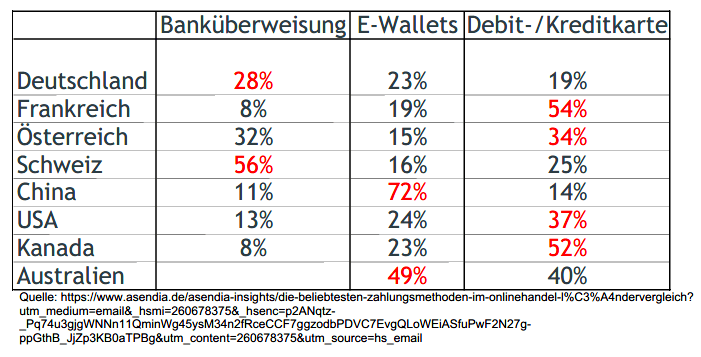

The RetailX Global Ecommerce Report 2022 and the RetailX Europe Ecommerce Region Report 2022 contain very exciting information on this. According to Statista weree-walletsandDebit/Credit Cardsin 2021 the most used payment methods in e-commerce worldwide. E-wallets were the most popular payment option and were used for around half of all transactions. E-wallets are particularly popular in Asia. Well-known examples of e-wallets are Apple Pay, Google Wallet, PayPal as well as Alipay and WeChat Pay in China. However, there are clear country differences here and it shows that in Germany and Switzerland bank transfers are still clearly ahead: